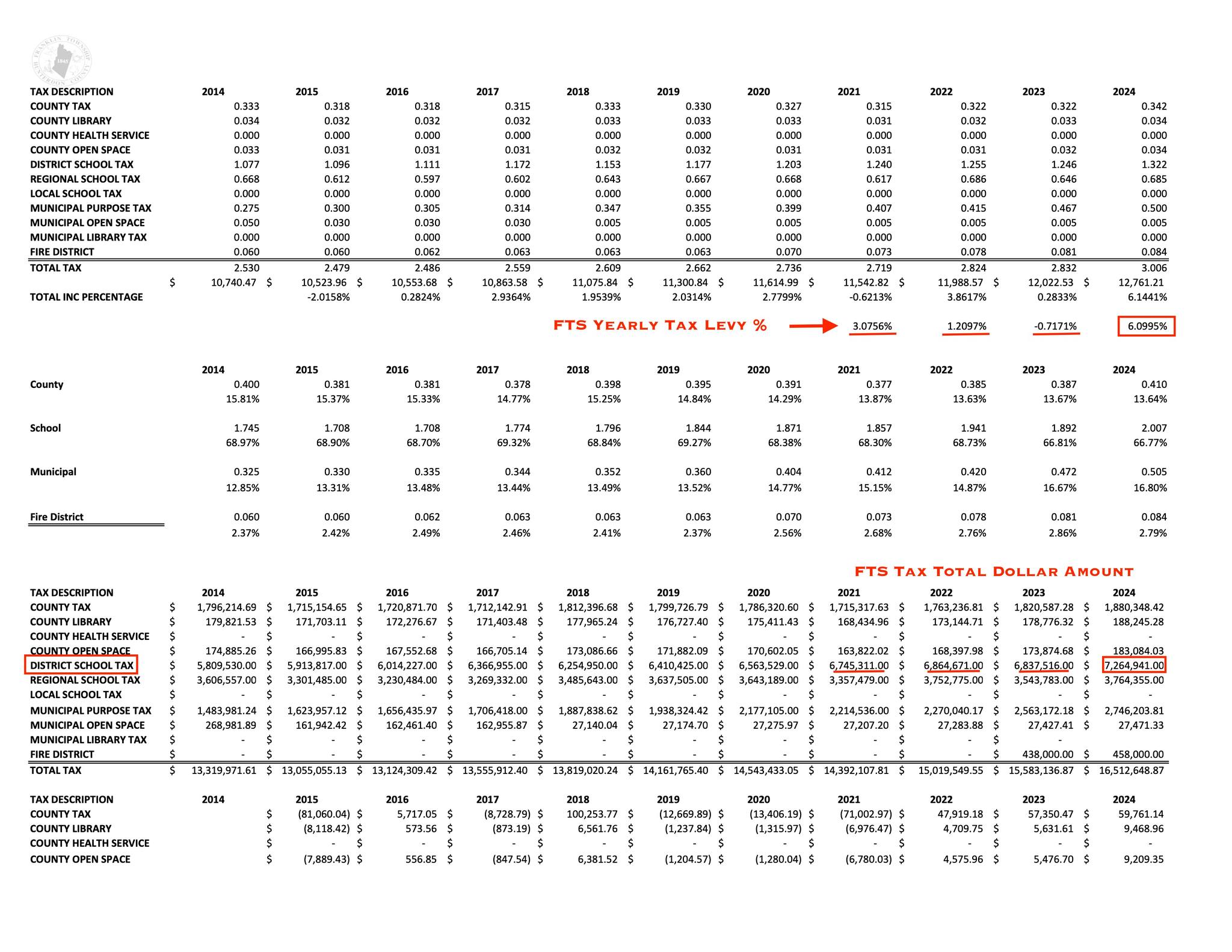

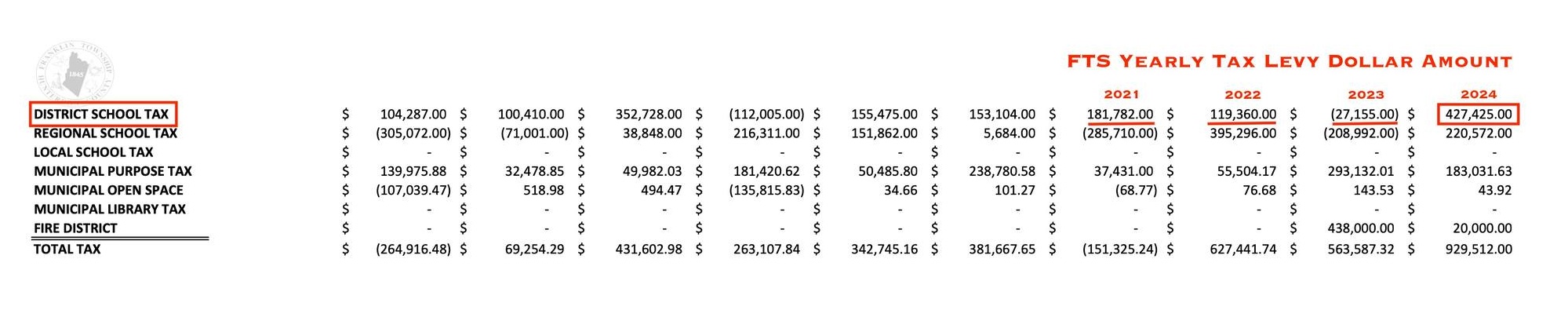

You’ve most certainly felt the astounding 6.0995% school tax levy increase voted in this summer by FTS’ current Board of Education and suggested by the former Superintendent. The total dollar amount of that tax increase was $427,425.00 for FTS year over year. Since historically these tax levies rarely ever go down, these BoE’s yearly tax increases may be permanent. We not only want to quickly highlight the background to this huge increase, but also point out how the BoE has failed to explain to the community why this is needed nor demonstrated how it is part of a strategic financial plan.

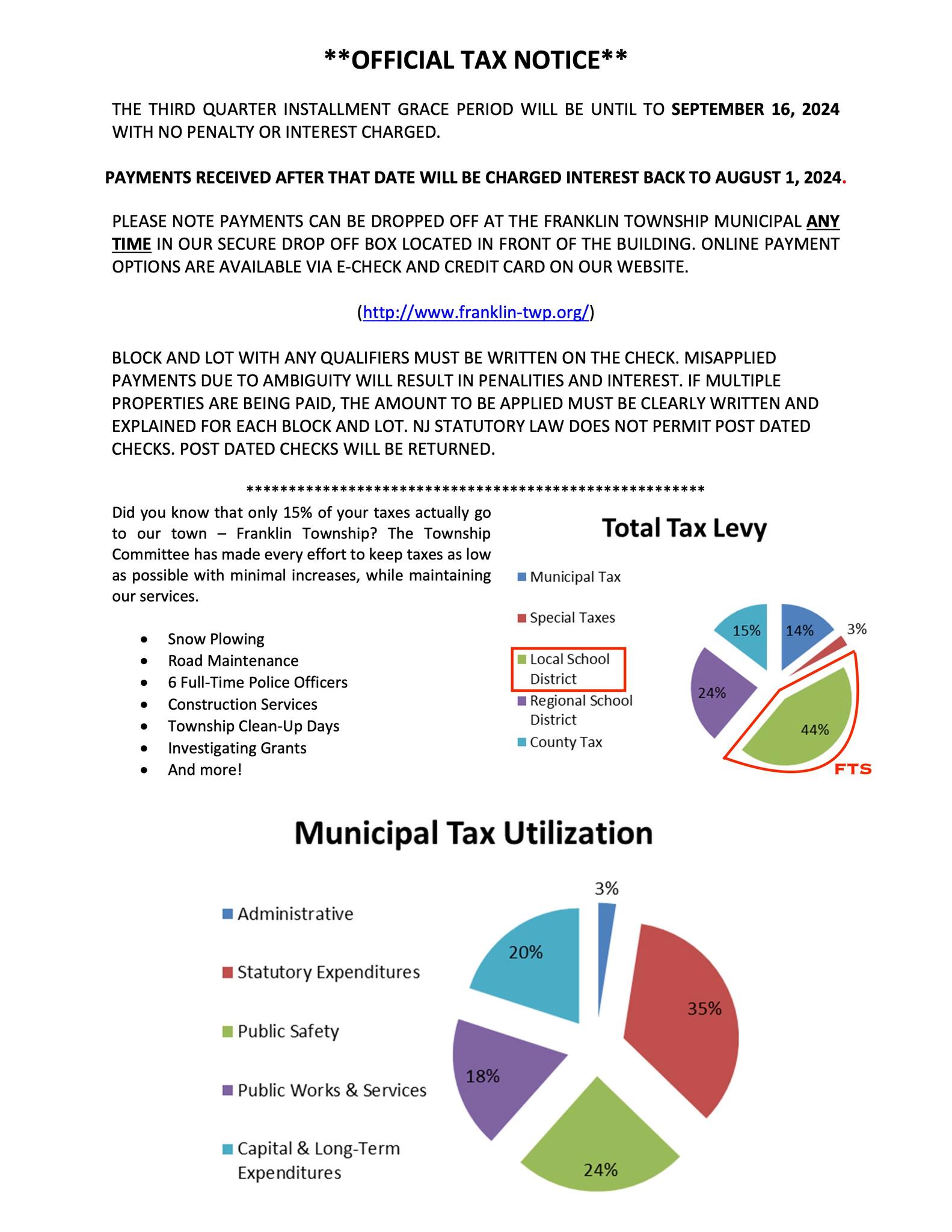

Attached is a Municipal Tax Breakdown spanning the last ten years. It was requested by us and created by Franklin Township Municipal Office. (Attachment A & B – Township seal top left.) According to the township’s breakdown, 2024 was the highest single item increase in over ten years and that’s across all tax service categories. With FTS alone collecting 44% of the entire property tax bill (Attachment C), the BoE budgeting decisions created the direct cause and effect on the town’s historic overall tax increase of 6.1441%. When we asked the township committee why our taxes seem so out of control this year, they pointed us directly towards the Franklin Township Board of Education. None of these higher taxes’ address capital investments or improvement needs, it’s just a strangely specific 6% increase to FTS’ year over year operation budget with no recording or explanation of ‘why’ given to the community while board minutes cite the BoE’s own decision to exit school choice as supporting reason for the tax levy increase.

Small, consistent increases to other town services (police, fire, public works etc.) are expected and consistent with good planning. Contrast those to FTS’ yearly line items. Percentages around 2021 start dancing all over the place, further signaling a lack of organization and/or strategic planning. Most specifically, the 2024 tax raise seems like an attempt in recouping the BoE’s own ’22 & ’23 tax cuts by taking advantage of unused spending authority or the tax cap flexibility bill, neither of which require public vote for approval.

Despite the unprecedented tax increase there was no explanation to the community who only found out the moment they opened their tax bill. The ’22 & ’23 choices were to reduce funds that were clearly needed the following calendar years, and the BoE used a little-known tax cap waivers to hit the community big to fix their decisions. The probability that BoE were able to add great services like the resource office and equipment without cutting an educational service or teachers in ’23 while still achieving a -0.7171% tax levy decrease is very small. What’s even more questionable is that according to board’s own minutes, the original discussion was to raise the ’23 school tax levy by 11% before the need for that simply disappeared. The municipality reported having trouble even getting Franklin Twp School’s 2023 operation budget, with it also arriving last-minute to the town office. In line with county clerk’s office account that the bond referendum arrived last-minute as well as this last-minute handling of the interim superintendent.

Neighbors, the reality is that 2024 school levy is the highest in our district’s history and we’re not here to talk politics or share our stories about Mrs. Fortunato & Mr. Huber’s awesome stitch bucks; we all know they are awesome. We’re here to discuss real money and the primary functions of the Board of Education, the business of education. By all reasonable metrics that concern taxpayers and students, business is not doing well and there’s an uncomfortable discrepancy between value vs cost that the current board president admittedly now believes is worth generally looking into for the first time.

Increases like this should be thought out, communicated and incremental so taxpayers have time to plan and prepare. We believe our town deserves a blue-ribbon school, especially for this price tag. A new vanguard is needed at the Board of Education to ensure common sense and common cents are given equal consideration.